AI & ML based scoring

We determine the credit-worthiness of each client, using behavioral scoring model.

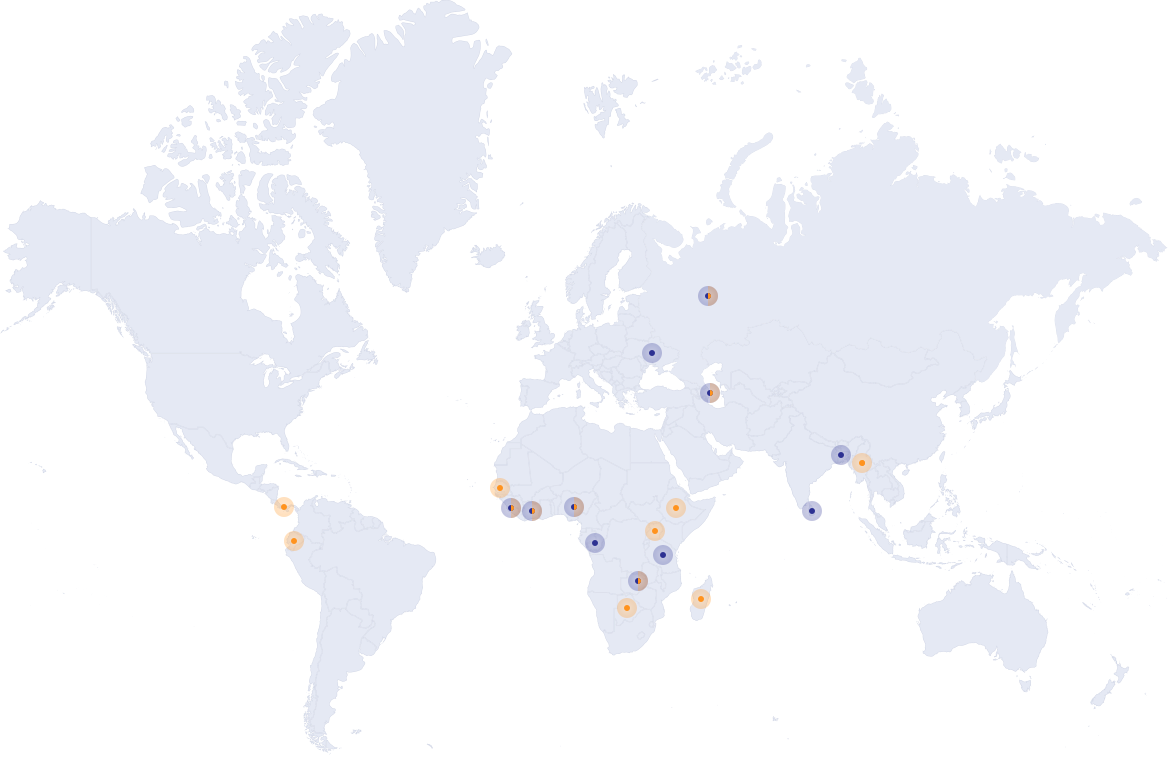

We are serving over 25 companies in 20 countries worldwide and this number is growing with new launches every quarter.

We determine the credit-worthiness of each client, using behavioral scoring model.

We deliver microlending solution which includes processing, disbursement, repayment, recovery and management of loans.

We use latest advancements in Artificial Intelligence and Machine Learning to maximize our value proposition.

Data as a Service (DaaS) is a complex approach aimed at monetization of MNO’s Big Data relying on advanced techniques in analyzing telco usage. A user-friendly and fast ecosystem is built for various providers of goods and services be equipped with access to valuable data for making lending decisions.

Using variety of accessible data, decision is made on eligibility of any given individual independent on whether they have or not credit history. Complex product system is built with scoring engine and loan management platform as core components.

Enabling embedded finance to all credit-invisible customer segments of a bank – via using sophisticated scoring engine and state-of-the-art loan management platform. Our solution greatly reduces cost of the lending process as well as efficiently managing risks of the same.

Enabling embedded finance to all customer segments of a mobile wallet passing through creditworthiness assessment based on AI/ML driven scoring algorithms. Loan servicing module presents as well.

Buy Now Pay Later solution technically integrated into any ecosystem featuring e-commerce, marketplace etc. for transparent access allowing the end-users to take advantage of making installment-based purchases.

Lending an airtime to MNO customers on the premise that they will pay back with a bit of premium. Built-in machine learning system provides for maximum profitability of the business model.

While scoring engine and set of algorithms are core of all Simbrella’s solutions, it is possible to implement scoring as a standalone component should such a need arise at any of our potential clients – banks, MNO’s, mobile wallets etc.

Worried about protection of sensitive data? We created data anonymizer solution for this particular purpose – it’ll help to carry on all scoring and lending activities in any customer base without disclosing actual customer information.

END USERS SERVED GLOBALLY

OUR GLOBAL PRESENCE

TRANSACTIONS PER DAY

Current operations

Advisor to the Chief Executive Officer

Chief HR & Administrative Officer

Chief Product & Fintech Officer

Chief Commercial Officer

Chief Strategy Officer

Chief Data Science & Analytics Officer

Chief Financial Officer

Sales & Accounts Head

Regional Sales & Accounts Management Director

We are looking for passionate and talented people to join our growing team. If you want to find out your highest heart rate and fill up your life with passion, then welcome to Simbrella.